Planning for the future when so many variables are uncertain and the broader impacts on the economy as a whole remain unclear is a formidable challenge.

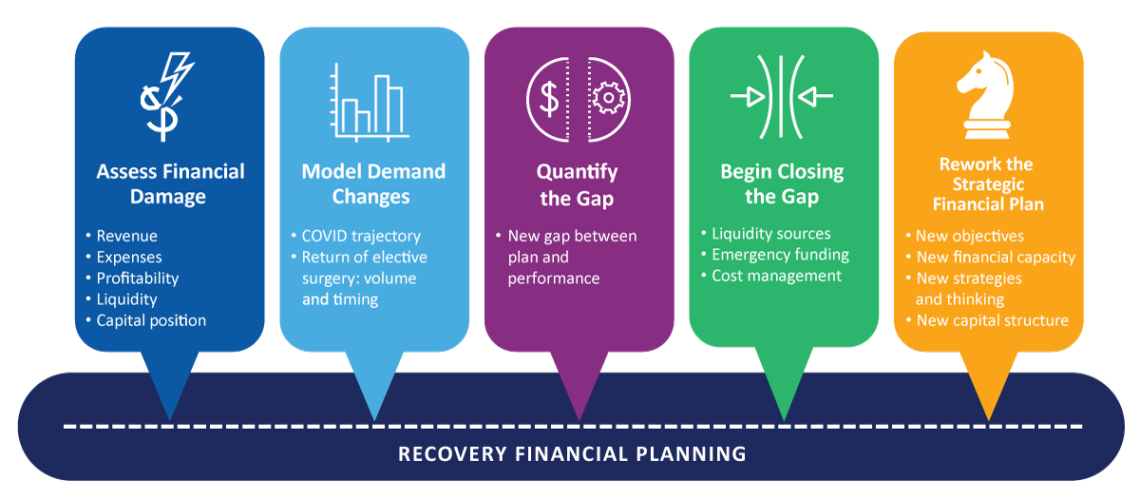

Leading healthcare organizations are crafting a recovery path that includes these five steps:

- Assess the financial damage. Determine the volume and revenue loss resulting from COVID-19, the unbudgeted expenses, and the effects on profitability, liquidity, and capital position.

- Model demand changes. Begin building scenarios that show related movement of revenue, the relationship between revenue scenarios and plans to manage expenses, and other strategies that will take the organization through the next year.

- Quantify the gap. The financial and strategic plans of most organizations aim to close a gap between a current and desired financial performance. The financial damage of COVID-19 creates a new and far larger gap that needs to be precisely quantified.

- Begin closing the gap. While government funding will help organizations close unexpectedly large gaps, the reality is that most organizations likely will be caring for unknown volumes of COVID-19 patients for some time to come, which will continue to affect operations, non-COVID volumes, and revenue.

- Rework the strategic financial plan. With the impact of COVID-19, most organizations will find that their existing strategic and capital plans are no longer financially feasible. In addition to doing the best to close the financial gaps, hospitals will need to revise their strategic objectives and look differently at their capital expenditures.

Scenario modeling in the financial planning process

Software tools will be critical to support a truly data-driven recovery plan. An automated financial planning tool can play an important role in helping organizations efficiently model volume assumptions, reimbursement and funding expectations, new business strategies, and capital plans.

Financial planning applications support recovery plans by helping finance teams:

- Link strategic mission and vision to measurable financial objectives

- Evaluate multi-year financial projections for sustainability and risk

- Model the impacts of alternative financing approaches by integrating scenarios for debt, fundraising, investments, and capital projects

- Communicate how financial plan projections influence capital generation and strategic priorities

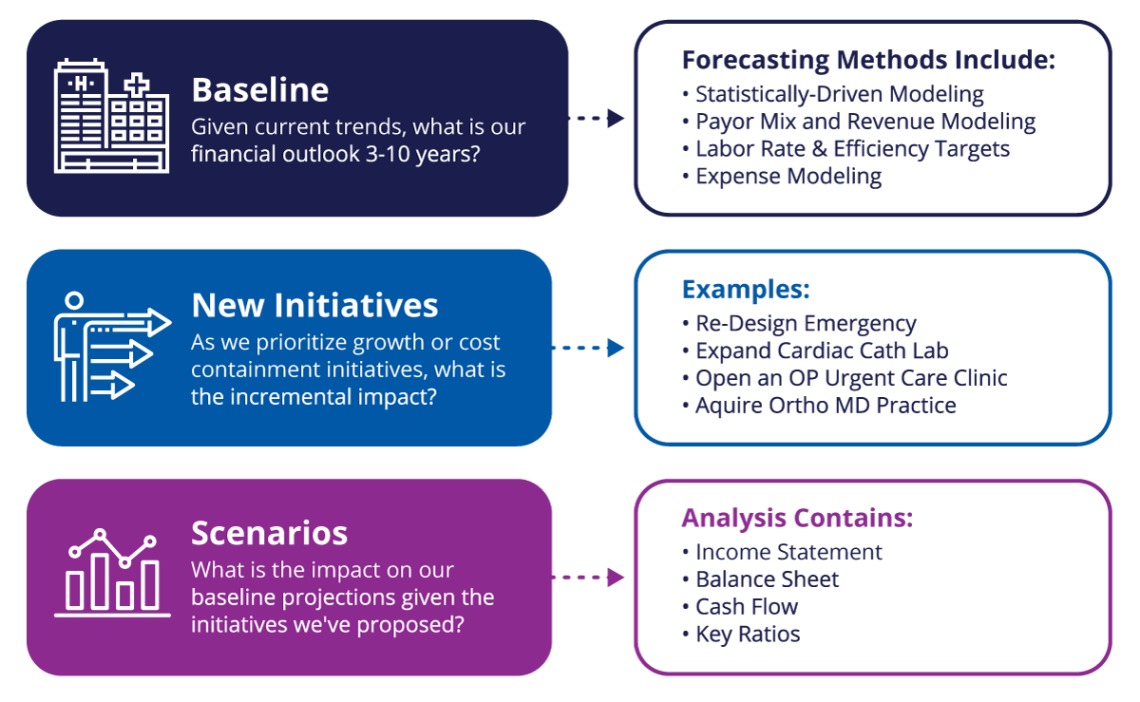

Initiatives planning and scenario modeling help decision-makers understand the specific impacts of key variables across a range of business scenarios. Financial Planning is designed to support both driver- and scenario-based planning with menus, processes, and model attributes to rapidly create scenarios.

While no organization is well-equipped to predict the future with great precision, automated financial planning tools can assist by simulating different business scenarios.

Effective tools for scenario modeling should incorporate the following components:

- Driver assumptions: Identify the key drivers to the business with independent or causal variables stored independently of the business logic, so they can be viewed and easily modified. Model multiple assumptions with side-by-side comparisons of the projected impacts of different market and internal drivers on operating performance and the balance sheet.

- Business logic layer: Transparent algorithms emulate your organization’s dynamics so planners can easily tune their models. By using pre-established metrics from the financial plan, you can define and manage an optimal strategic portfolio.

- Collaboration, inputs, and overrides: Your subject matter experts can review and make judgments regarding expected results, with embedded workflow logic.

- Scenario storage: Efficiently store scenarios in the model repository with straightforward naming, storing, and retrieval.

- Scenario presentation: Powerful, high-level sensitivity analysis provides a quick view of the impact of specific inputs to your model. Reports and dashboards display side-by-side comparisons, including key drivers and financial data so reviewers can see the detail and business logic that drive results.

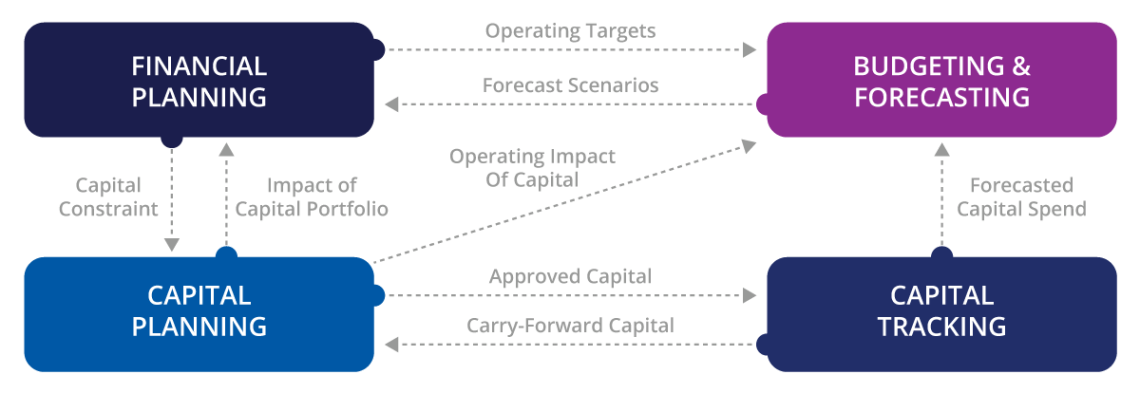

Enabling an integrated planning model

Recovery plans will need to be continuously re-evaluated. It’s critical to efficiently simulate multiple versions of the future, understand the risks and potential impacts, and then align targets effectively across other planning tools and processes.

A robust integrated financial planning suite can help finance deliver a more agile and responsive recovery plan. While process automation is vital, it is equally important that the platform scale and evolve to address the ever-changing and increasingly sophisticated business modeling required to support strategy formulation, strategy alignment, and performance monitoring.