National labor shortages continue to plague the nation’s healthcare system. The industry has endured shortages on and off for decades among nurses, physicians, and other key clinical positions, but broader shortages triggered by the pandemic, inflation, and other economic forces have amplified the challenges in recent years.

High labor expenses are pressuring operating margins and creating significant financial instability for many providers. Healthcare leaders nationwide are grappling with how to contend with an increasingly tight labor market and a new normal of near-term rising costs.

To address these concerns, leaders said their top priorities are managing and reducing costs, and workforce optimization and productivity, according to a new Syntellis survey of more than 100 U.S. healthcare finance leaders.i It’s no surprise that survey respondents also cited employed and contract labor costs as the expenses most likely to keep them up at night in 2023.

This article examines recent data on mounting pay rates for hospital workers, how labor and non-labor expense increases are affecting operating margins, and the impacts of contract labor costs.

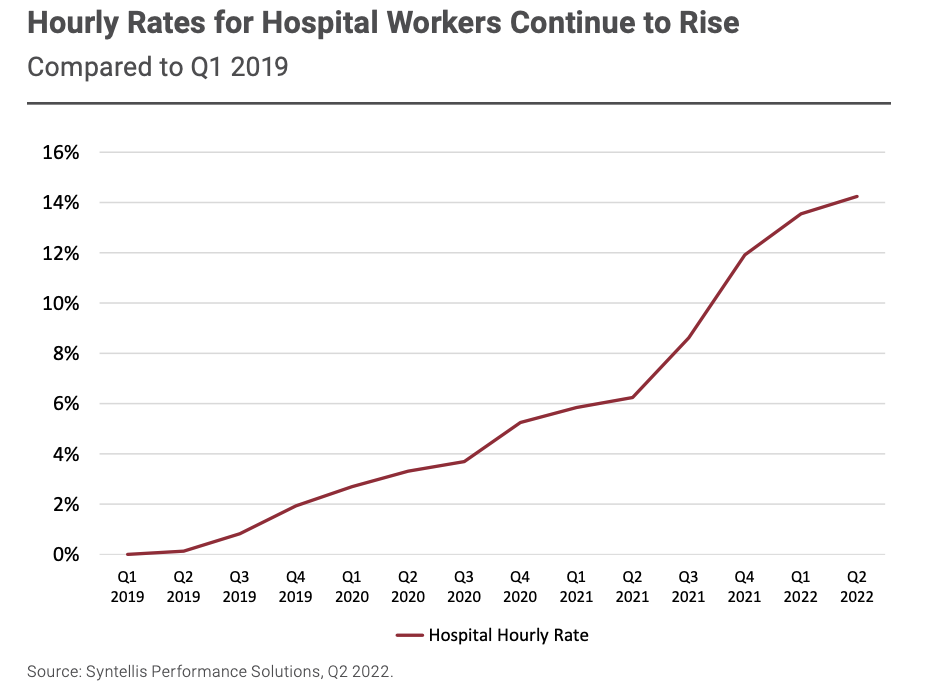

Hourly Pay Rates on the Rise

Escalating labor costs and a shrinking labor pool are straining hospitals across the country. Many organizations have raised salaries and wages in response to steep inflation and intense competition for qualified healthcare professionals.

According to a recent report from Syntellis and the American Hospital Association, hourly pay for hospital workers has been on the rise since 2019. The report, which analyzed data from more than 1,300 U.S. hospitals and health systems, found the median hourly rate for hospital workers (including contract and employed workers) rose to a new high up 14% in the second quarter of 2022 compared to the first quarter of 2019 (Figure 1).

Hospitals in many states have laid off employees in response to rising costs.ii Bozeman Health in Montana, for example, announced in August 2022 that it laid off 28 leaders and would leave another 25 leadership positions unfilled.iii In May, St. Charles Health System in Oregon announced it planned to cut 181 positions, due in part to rapidly rising labor expenses.iv

Some groups have cited concerns that lower staffing levels jeopardize patient care. In September 2022, the Minnesota Nurses Association led a three-day strike involving 15,000 nurses from 15 hospitals because of patient care concerns from understaffing. It was the largest strike of private sector nurses in U.S. history.v

Even with significant cuts, hospitals have been unable to stem operating margin declines.

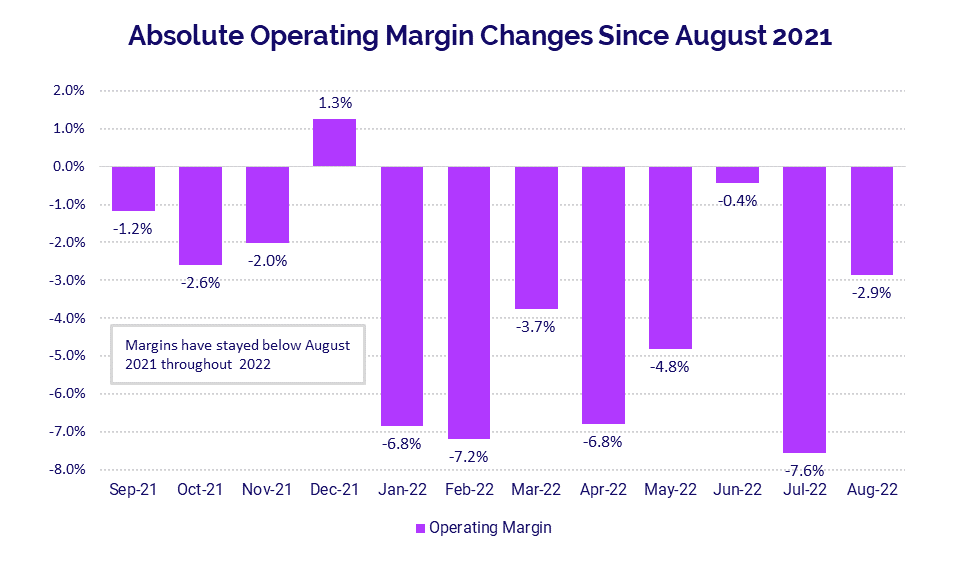

Labor Shortages Strain Margins and Expenses

Hospital operating margins declined nationwide throughout 2022 to date as hospitals battle increasingly high expenses (Figure 2). Compared to August 2021, the absolute change in Operating Margin dropped -2.9 percentage points in August after falling -7.6 percentage points in July.

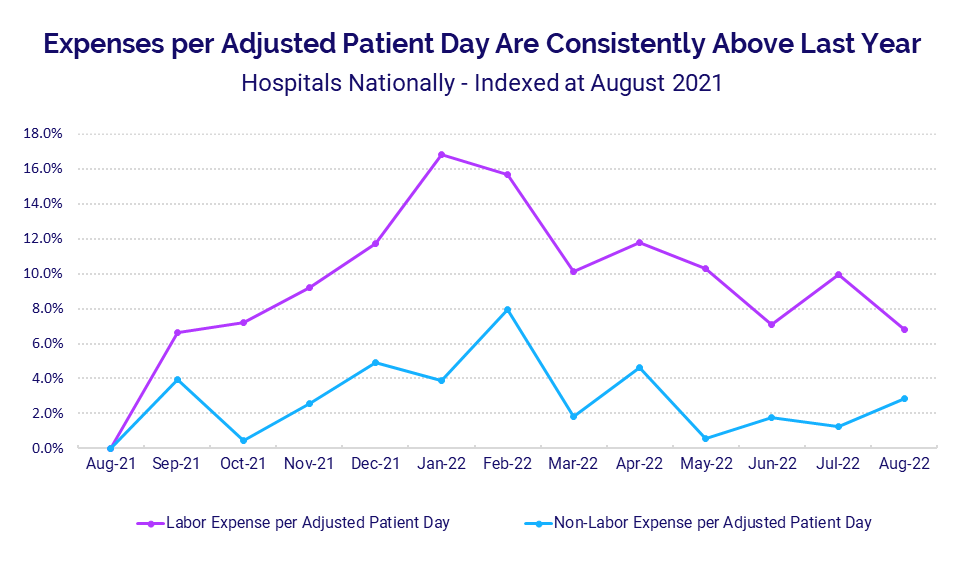

At the same time, labor expense increases outpaced non-labor increases for the past 12 months (Figure 3). Compared to August 2021, Labor Expense per Adjusted Patient Day peaked during the Omicron surge in January, jumping 16.8%. While the rate of increases lessened in recent months, the metric remained up 6.8% in August 2022 compared to the same baseline.

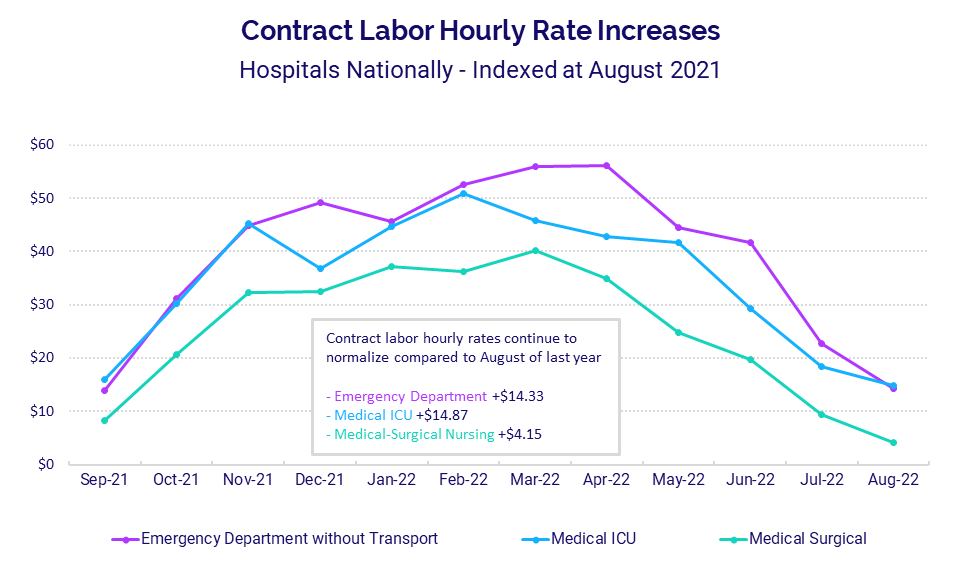

Contract Labor Cost Increases Lessen

Sustained high contract labor costs compounded rising hospital expenses over several months, but organizations may be seeing some relief. Contract labor costs spiked in early 2022 but have softened in recent months (Figure 4).

In April 2022, the median Contract Hourly Rate for Emergency Department personnel, for example, peaked at $56.17 above August 2021 rates. Those rates dropped more than $41 per hour by August 2022.

Find Solutions with Data and Analytics

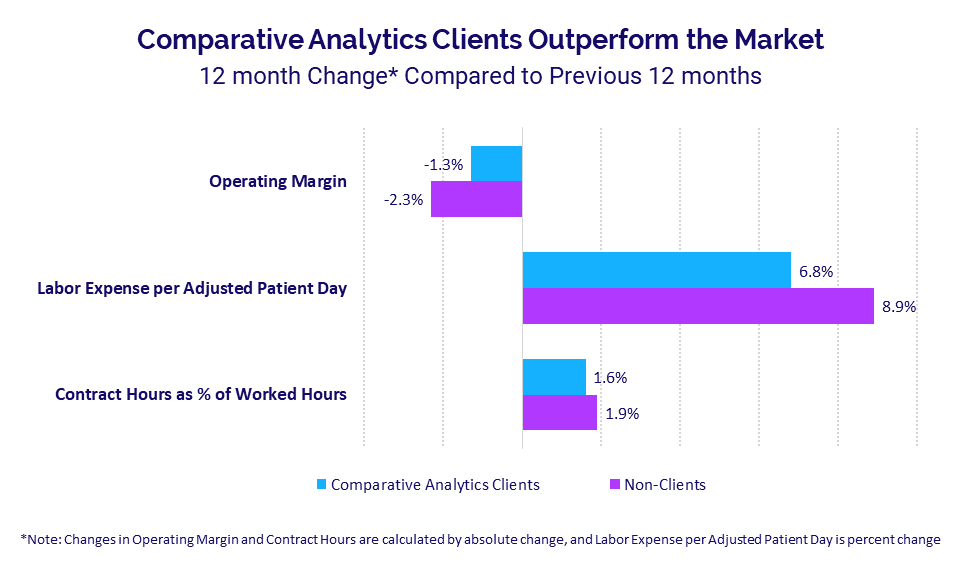

Robust data and analytics tools offer valuable insights for healthcare organizations working to navigate mounting expenses. An analysis of 180 organizations that use Axiom™ Comparative Analytics shows they are better able to control margin declines, labor cost increases, and contract hours (Figure 5).

Operating Margins decreased -1.3 percentage points over the past 12 months for hospitals that use Syntellis’ Axiom Comparative Analytics, compared to -2.3 percentage points for non-users. That means users’ Operating Margins are a full percentage point higher. Looking at expenses, Labor Expense per Adjusted Patient Day increased 6.8% for Comparative Analytics users versus 8.9% for non-users.

The future course of healthcare’s volatile labor market and its long-term impacts remain unknown. As these results illustrate, sound data and analytics are essential to helping healthcare leaders identify cost drivers and model potential scenarios for informed decision-making to set organizations on the best path forward.

Sources: i Syntellis Performance Solutions: 2023 Healthcare CFO Outlook Survey. September 2022.

ii Ellison, A.: “10 Hospitals Laying Off Workers.” Hospital CFO Report, June 1, 2022.

iii Houghton, K.: “Hospitals Cut Jobs and Services as Rising Costs Strain Budgets.” Kaiser Health News, Aug. 26, 2022.

ivSt. Charles Health System: “Difficult Times, Difficult Decisions.” Press release, May 18, 2022.

vMinnesota Nurses Association: “15,000 Nurses Determined to Win a Fair Contract to Put Patients Before Profits After Historic Strike.” Sept. 15, 2022.

Learn more about comparative analytics with Axiom