“We needed something to bring us up to date,” recalls Todd Wenzel, Chief Accounting Officer of Minnwest Bank. “We had a core general ledger system and it was the repository for the accounting entries, but not much of a flexible reporting system. That was holding us back.”

Family-owned and Minnesota-based, Minnwest Bank serves a broad range of customers, from large commercial and agricultural entities to individuals. The bank is seen as big enough to get large deals done, yet small enough to truly listen and collaborate. Priding itself on its commitment to a “relationships-first” ethos, the bank is dedicated to both economic development and community involvement, including volunteer work and philanthropic giving.

New capabilities open opportunities

To maintain its commitments to customers and the community, Minnwest Bank wanted to leverage technology to increase the bank’s competitiveness. After vetting multiple vendors, Minnwest implemented Syntellis’ Axiom™ Planning, Axiom™ Reporting and Analytics Platform, Axiom™ Funds Transfer Pricing and Profitability, and Axiom™ Incentive Compensation Management systems. “We went with Axiom because it promised the agility and flexibility we needed,” Wenzel explains, “and the fact that it renders in Excel. We like Excel, but we don’t necessarily want it to be the backbone of all our number crunching and reporting.”

Since implementation, Wenzel marvels at the time-savings in reporting, querying, and investigating data. “Reporting that used to take hours or days now takes seconds or minutes,” he says. Each of the bank’s three affiliate companies upload their financials to Axiom for consolidated financial reporting. “This opened up a new world of analysis and reporting for us across the organization. Axiom lets us implement profitability reporting and analysis at the product, customer, and organizational levels—none of which we could do before.”

The bank is now calculating incentives based on funds transfer pricing (FTP) to better measure branch and officer contributions to bank profitability. They are now able to close the performance management loop of financial performance, reporting, incentives and budgeting. “We’re now looking at granular level profitability down to the individual, and more managerial accounting instead of only financial accounting,” aligning individual goals with the institution’s strategic goals.

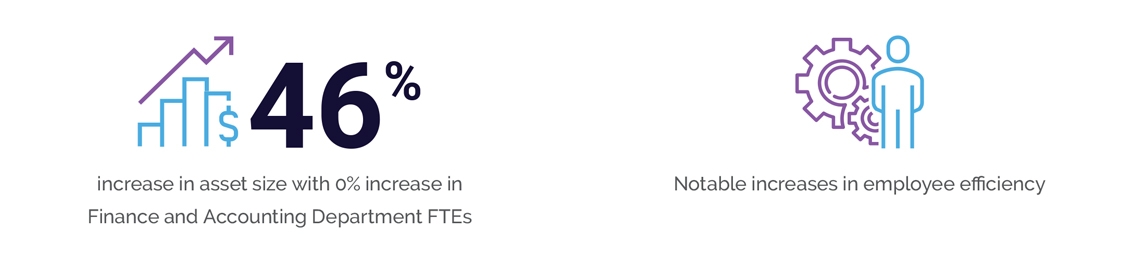

Like most banks, Minnwest is challenged with different organizational structures and frequent realignments, reorganizations, and acquisitions. “Now we can quickly edit a table to completely redesign the rollups of those different groups to the top of the house. That is one area that used to take a great deal of time and effort.” Wenzel points to notable increases in his department’s efficiency after implementing Axiom as well as reporting and analytics capabilities not available to the Bank prior to its implementation.

Increasing profits without increasing headcount

Another big efficiency gain occurred in research. “When you find an anomaly, like a budget variation, you can drill down in Axiom on the fly. Axiom is in the cloud so you can maintain that data for as long as you want, and it takes minutes instead of hours to get the information you need.”

These efficiency gains have produced significant savings. Since implementation, the bank has grown in asset size from $1.6 billion to $2.3 billion. “Prior to implementation we merged our six bank charters together and post implementation we made three bank acquisitions without needing to grow our department headcount at all. We are one of the few support departments in the bank that hasn’t grown in FTEs because the system has taken a lot of that burden off us,” Wenzel says.

Better planning, accuracy, and accountability

Accurate, in-depth reporting makes it easy to disseminate up-to-date information throughout the organization— improving both decision-making and accountability. “Certain financial and managerial reports go to the Board,” Wenzel states. “They also go to the C-Suite and management group. But then we have a number of automatically generated weekly and monthly score cards so that people and branch management on the front lines can monitor their sales and KPIs. The mission is to grow accountability and create a meritocracy based on individual, branch, and collective performance.”

Looking forward, Wenzel expects Minnwest Bank growth in excess of 3%-4% per year—and even greater growth when fueled by acquisitions. “Typically, you have a closing date and a conversion date,” he explains. “In the period between those two dates, it’s often difficult to flexibly and efficiently merge the new acquisition’s financial information with your own. Axiom really facilitates that reporting from day one.” To him, that’s another facet of the myriad tools Minnwest Bank now leverages to grow, and thus keep its commitments to customers and the community. “We are pretty small compared to some of the banks that are using this software,” Wenzel concludes, “but I know it will take us to wherever we need to go.”

Your peers also read:

Axiom Eases Budgeting Challenges, Increases Data Transparency for Valley Strong Credit Union

American National Bank of Texas Saves Time and Labor with Efficient Financial Planning