Relationship Profitability & Pricing

Price and Manage Portfolios Based on Relationship Profitability

The Axiom™ Relationship Profitability and Pricing System (RPPS) provides the framework to build and manage complex relationships, understand and leverage profitability analytics, and accurately price new business―allowing you to optimize profitability and best serve customers.

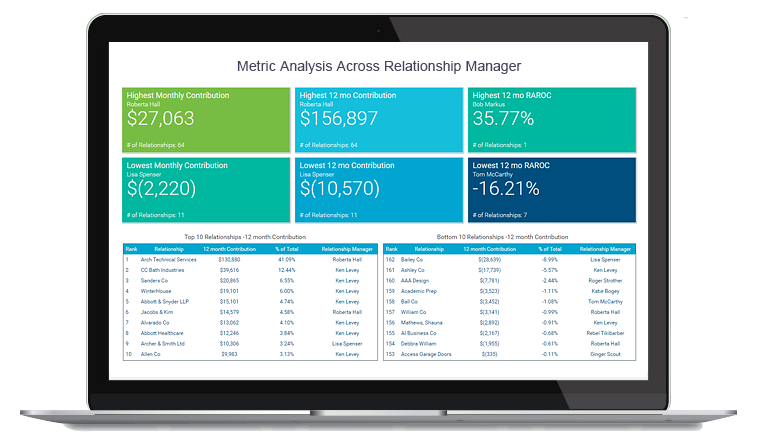

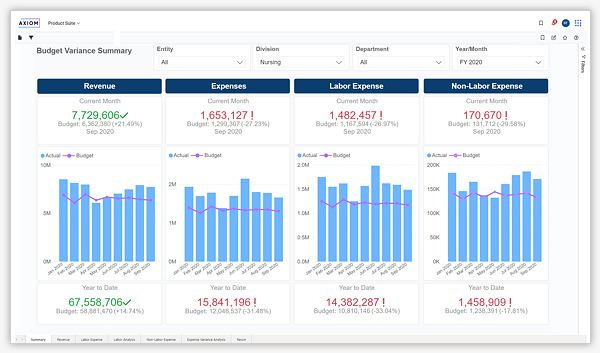

Generate Comprehensive Reporting

Provide your relationship managers with reports detailing their portfolio profitability and empower management with profitability data to fuel business decisions and incentive compensation plans

Incorporate Costing Data

Apply costs at the customer account and transaction levels to ensure accurate relationship profitability calculations. Leverage cost rates by product or transaction from Axiom or utilize a third-party source

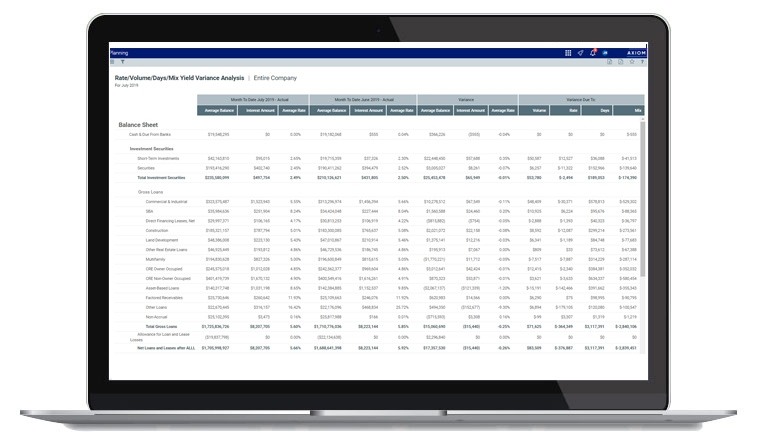

Get A Rolling Profitability View

See the current and historical profitability for each account and customer based on matched-term funds transfer pricing calculations of net interest margin, non-interest income and expense, and provision for loan loss

Compare Pricing Scenarios

Select the best pricing scenarios to support the relationship and optimize profitability; automatically generate and submit the proposal with supporting profitability calculations and metrics

Who We Help

The Axiom Relationship Profitability and Pricing System (RPPS) provides a single solution serving institution leaders, relationship managers and other front-line staff.

Leadership

Institution leaders in finance and lending rely on the analytical capabilities of Axiom RPPS to:

-

Employ a consistent calculation approach for historical and projected profitability

-

Understand the risks and opportunities around top and bottom-performing relationships

-

Incent profitable growth through evaluation and compensation of front-line performance

Front-Line Staff

Relationship managers, loan officers, branch managers and other front-line staff need better visibility to your institution’s relationships and their economic impact. Axiom RPPS helps you:

-

Price new business based on empirical profitability, quickly understanding current relationship contribution, margin impact of adding products, forecasted ability to meet your hurdle rate, and which pricing scenario maximizes client satisfaction

-

Best serve each client, leveraging visibility to the full breadth of a client's relationship and associated accounts

-

Maximize portfolio profitability, identifying top and bottom performing relationships to inform relationship plans and business decisions

Fully realize the value of each account, customer, and relationship in your portfolio